Anthem Biosciences IPO Sees Strong Demand: Everything You Need to Know About This ₹3,395 Crore Public Issue

Anthem Biosciences IPO worth ₹3,395 crore fully subscribed. Explore detailed insights into the company’s financials, IPO structure, investor sentiment, and long-term growth potential.

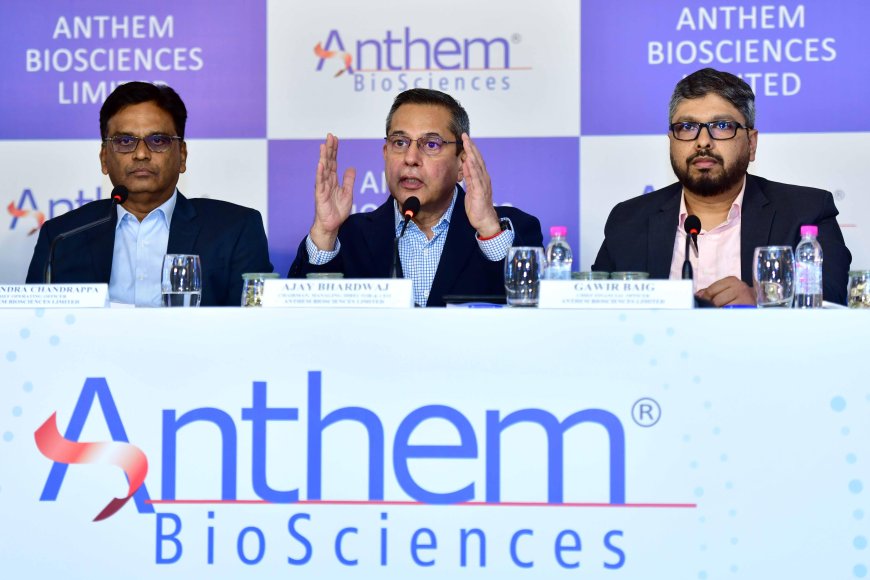

Bengaluru-based pharmaceutical services company Anthem Biosciences Ltd has officially entered the public market with a bang. Its initial public offering (IPO), valued at ₹3,395 crore, has seen overwhelming demand across investor categories, highlighting the growing investor appetite for India’s contract research and manufacturing sector. From robust financials and global client reach to a promising outlook in biotech, Anthem’s IPO has caught the attention of retail and institutional investors alike.

Let’s take a deep dive into the company’s background, IPO details, financial health, subscription status, and what it all means for potential investors.

Who Is Anthem Biosciences Ltd?

Founded in 2006, Anthem Biosciences Ltd operates as a Contract Research, Development, and Manufacturing Organization (CRDMO), offering end-to-end services in the pharmaceutical and biotechnology domains. The company is based in Bengaluru and has grown rapidly over the years to become one of India’s leading players in the space.

Its capabilities cover both small and large molecule development, including chemical synthesis, fermentation, cell culture, and protein expression technologies. Anthem serves clients across the globe, spanning over 44 countries, with a client portfolio that includes pharmaceutical majors, biotech startups, and nutraceutical firms.

IPO Overview

Anthem Biosciences’ IPO opened for subscription on July 14 and will close on July 16. It is purely an Offer for Sale (OFS) by existing shareholders, meaning no fresh capital will be raised for the company’s operations. The total offer size is ₹3,395 crore.

Key IPO Details:

-

Price Band: ₹540 to ₹570 per share

-

Lot Size: 26 shares (minimum investment of ₹14,820)

-

Total Shares on Offer: Over 5.9 crore equity shares

-

Face Value: ₹2 per share

-

Listing Exchanges: NSE and BSE

-

Tentative Allotment Date: July 17

-

Expected Listing Date: July 21

Despite being an OFS, the IPO has generated considerable buzz due to the company's performance and strategic positioning in the pharmaceutical value chain.

Subscription Status So Far

As of the second day of the offering, Anthem Biosciences IPO had been subscribed over 3.2 times in total. The demand has been especially strong among Non-Institutional Investors (NIIs), who have subscribed nearly 10 times their allotted quota. Retail Individual Investors (RIIs) have also shown healthy participation, with their portion subscribed more than 2 times.

The Qualified Institutional Buyers (QIB) portion is expected to pick up on the final day, as is common practice with large institutional players. Early indications of interest from mutual funds and foreign institutional investors are also fueling optimism for a strong listing.

Grey Market Sentiment and Premium

Anthem’s IPO is trading at a grey market premium (GMP) in the range of ₹115 to ₹120. This suggests potential listing gains of approximately 20% over the upper price band of ₹570 per share. While GMP isn’t a foolproof indicator of listing performance, it does reflect prevailing investor sentiment and momentum.

Business Strengths and Growth Drivers

There are several reasons why Anthem Biosciences is generating buzz among investors. Some of the key strengths that make this IPO attractive include:

-

Integrated CRDMO Model: Anthem offers services from early-stage drug discovery to commercial-scale manufacturing. This comprehensive offering gives the company an edge over competitors who only operate in specific segments.

-

Global Regulatory Compliance: The company’s facilities are approved by major regulatory bodies such as the US FDA, EMA, TGA (Australia), PMDA (Japan), and ANVISA (Brazil). This enhances its ability to serve clients globally and opens doors to regulated markets.

-

High Operating Margins: For FY25, Anthem reported an EBITDA margin of over 36% and a net profit margin of 23.4%, making it one of the more profitable companies in the sector.

-

Strong Client Base: With more than 550 active clients and over 8,000 completed projects, Anthem has a diversified and loyal customer portfolio that spans across pharmaceuticals, biotech, and nutrition industries.

-

Capacity Expansion: The company is in the process of expanding its manufacturing capacity with a third plant at Harohalli. This will allow it to handle larger orders and increase revenue potential in coming years.

-

Global Pharma Shift from China: Amid global efforts to reduce dependence on Chinese supply chains, Indian companies like Anthem are benefiting from increased outsourcing to India.

Financial Performance Snapshot

Anthem Biosciences has demonstrated robust financial performance over the last few years. Below are some key financial metrics for the year ending March 2025:

-

Total Revenue: ₹1,930 crore (up from ₹1,483 crore in FY24)

-

Profit After Tax: ₹451 crore

-

EBITDA: ₹705 crore

-

Return on Net Worth (RoNW): 36.7%

-

Debt-to-Equity Ratio: 0.21

The numbers reflect strong profitability and efficient capital utilization. The company’s consistent performance in terms of revenue growth and earnings has played a big role in building investor confidence.

Valuation Metrics and Peer Comparison

At the upper price band of ₹570, the IPO is valued at a Price-to-Earnings (P/E) ratio of approximately 70.6x based on FY25 earnings. While this may appear steep at first glance, it's in line with valuations of similar CRDMO and CDMO companies in India and abroad.

Given Anthem's profitability, global clientele, and growth plans, analysts believe the valuation is fair, albeit on the higher side. That said, the premium valuation does come with expectations of continued growth and strong execution.

Risks and Challenges

Despite its strengths, there are certain risks that potential investors must consider before investing:

-

High Valuation Risk: The IPO is priced aggressively, and any deviation from projected growth could impact stock performance post-listing.

-

Regulatory Risk: Since the company deals with multiple geographies and regulatory bodies, any compliance failures can have serious operational and reputational consequences.

-

Concentration Risk: A significant portion of revenue is derived from a small number of key clients. Any changes in these relationships could impact financial stability.

-

Currency Fluctuations: With a large portion of revenue from exports, the company is exposed to forex risks.

Analyst Views and Market Outlook

Market experts believe Anthem Biosciences is a quality company in a fast-growing segment. Several brokerage houses have given a “Subscribe” rating for the IPO, citing the company’s high margins, diversified client base, and strong global positioning.

Many analysts are optimistic about the future of the CRDMO sector in India, especially given the global pharmaceutical shift towards outsourcing and India’s emergence as a preferred manufacturing hub. Anthem, with its end-to-end capabilities and compliance track record, is well placed to leverage this opportunity.

Final Verdict

The Anthem Biosciences IPO has so far lived up to its hype. With full subscription already achieved and grey market trends indicating positive listing gains, investor interest is running high. For long-term investors seeking exposure to India’s expanding pharmaceutical services landscape, Anthem offers a compelling story backed by robust fundamentals.

However, given its premium valuation, it is essential to keep realistic expectations and consider one’s risk appetite. A careful watch on listing day and post-listing quarterly results will offer more insights into how well the company executes its growth strategy.