US–India Tariff Talks Narrow Focus as Steel and Auto Sectors Stay Off the Table

Amid shifting global trade priorities, US–India tariff talks are focusing on less contentious sectors, leaving out steel, aluminium, and autos from any interim trade deal.

As global trade tensions shift in the post-pandemic, post-BRICS expansion era, India and the United States have resumed critical discussions on sector-specific tariffs. However, both sides appear to be deliberately excluding high-stakes sectors—including steel, aluminium, and automobiles—from any short-term trade arrangements.

Multiple officials familiar with the negotiations confirmed that an “interim trade understanding” may be announced later this year, but it will not address contentious tariffs in legacy manufacturing industries. Instead, the focus is pivoting toward emerging trade corridors, digital services, pharmaceuticals, and clean tech collaboration.

This strategic shift underscores a realpolitik approach to de-risking bilateral tensions while building toward a broader Free Trade Agreement (FTA) framework in the future.

Why Are Steel and Auto Tariffs Being Left Out?

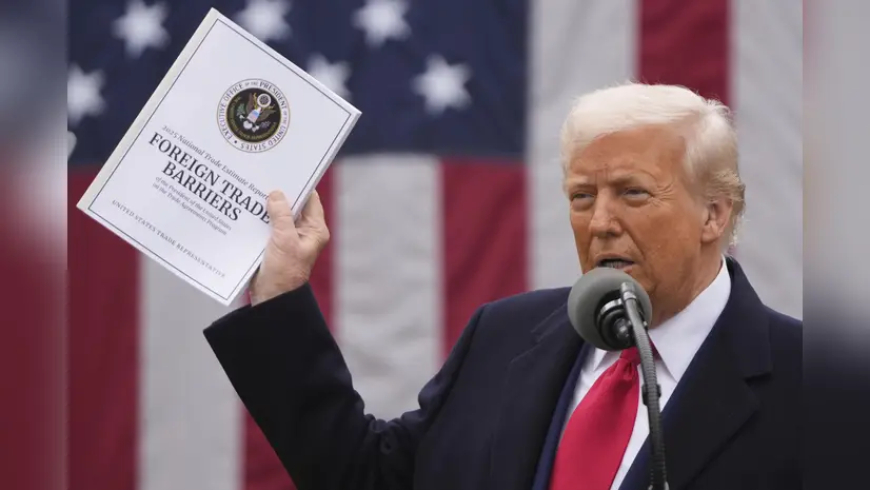

According to a senior Indian trade ministry official speaking on condition of anonymity, these sectors are “too politically sensitive” to be included in a stopgap deal. In the US, tariffs on steel and aluminium under Section 232 of the Trade Expansion Act, originally imposed by the Trump administration, are still in place and remain a point of friction not just with India but also with other G20 nations.

India had previously retaliated with duties on select American goods. While both countries have gradually rolled back some of those measures—notably under the US–India Trade Policy Forum (TPF) process—auto and metal tariffs remain deeply entrenched.

“This is not a sector we want to approach hastily,” noted a US Trade Representative spokesperson, hinting at broader strategic dependencies with American steel producers and labor unions.

What’s on the Table Instead?

The ongoing tariff discussions—revived ahead of the 2025 G20 summit—now aim to deepen cooperation in less politically volatile sectors. These include:

-

Pharmaceuticals and medical devices: Particularly for generic drug approvals and export incentives.

-

Digital economy services: Easing of data transfer regulations and taxation policies for Indian IT companies operating in the US.

-

Renewable energy components: Solar panels, lithium-ion battery inputs, and green hydrogen infrastructure.

-

Agricultural products: Some high-value exports like almonds and pulses may see relaxed import duties.

An interim pact could help reinforce the framework established under the US–India Initiative on Critical and Emerging Technology (iCET), launched in 2023 to boost high-tech industrial supply chains between the two democracies.

Strategic Timing and Global Trade Realignments

The bilateral conversation comes at a time when global trade blocs—particularly the expanding BRICS coalition—are repositioning themselves in opposition to Western-led systems. The U.S. is increasingly concerned about supply chain dependencies and market access distortions, while India seeks to insulate its own industries from external shocks and currency volatility.

“This isn’t about a quick resolution of past grievances, but about forging new rules for the future,” explains Dr. Sangeeta Menon, a trade analyst at Brookings India.

India’s newly ratified Production Linked Incentive (PLI) schemes, particularly in electric mobility and semiconductors, are also opening avenues for foreign investment—but not without protective layers. These are reportedly under review by American negotiators seeking greater transparency and non-discrimination clauses.

India’s Tariff Philosophy Remains Cautious

India continues to guard its tariff regime as an essential tool of industrial policy. While New Delhi has trimmed duties on over 400 products in the last 18 months, it has refused to commit to a blanket liberalization without reciprocal benefits in technology transfer and skilled migration.

In June 2025, India's Finance Ministry reiterated that tariffs remain a "first line of defense" against unfair dumping practices, especially in metals and industrial inputs.

“India’s position on tariff parity is not about protectionism, but about balanced reciprocity,” said Commerce Minister Piyush Goyal during a recent policy roundtable.

Potential Roadblocks

Despite signs of goodwill, there are sticking points that could delay a comprehensive agreement:

-

India’s demand for greater H-1B visa flexibility, particularly for STEM professionals.

-

Digital tax disputes, especially India's equalization levy on U.S.-based digital companies.

-

Concerns over intellectual property enforcement in pharmaceuticals and AI-based tools.

Any final deal would need to pass muster with domestic political constituencies on both sides—a particularly difficult task ahead of the U.S. Presidential elections in November 2026.

Broader Implications for Indo-Pacific Trade

The narrowing of focus in the US–India tariff talks could also redefine the economic contours of the Indo-Pacific. As India distances itself from Chinese-dominated supply chains, closer alignment with the U.S. offers a strategic counterweight to China’s dominance in critical minerals and rare earths.

Both nations are also working within the Indo-Pacific Economic Framework (IPEF), which, while not a traditional FTA, offers a template for digital trade norms, clean energy cooperation, and anti-corruption measures.

Conclusion

While the US–India tariff talks may not result in sweeping changes for now, the sectoral realignment signals a maturing of bilateral trade ties. By shelving the more sensitive tariff issues temporarily, both sides are choosing pragmatism over politics—an approach that may serve them well in an increasingly multipolar economic landscape.

As the global trade order evolves, this careful choreography between Washington and New Delhi could shape not just domestic markets but the future of democratic trade alliances.